Unauthorized Payments and the Rise of Fintech Innovations

In a rapidly evolving financial landscape, the recent surge of unauthorized payments linked to PayPal has sent shockwaves throughout European banks, particularly impacting institutions in Germany. With reports of blocked transactions totaling approximately 10 billion euros, the ramifications of these rogue payments extend beyond mere fiscal loss, highlighting the urgent need for enhanced fraud-checking systems. As traditional credit institutions grapple with these challenges, fintech innovations are emerging as pivotal forces in refining payment processing models. By incorporating cutting-edge payment technology advancements, the industry aims to mitigate risks associated with suspicious payments while ensuring seamless transactions for consumers. This article delves into the intricate interplay between unauthorized transactions and the burgeoning fintech sector, illustrating both the hurdles faced by European banks and the promising solutions that lie ahead, particularly in the realm of financial security.

Key Points Covered in This Article:

- Exploration of the recent surge in unauthorized PayPal payments and its impact on European banks.

- Detailed examination of fintech innovations that are reshaping payment processing models.

- Discussion on user perceptions of payment security following high-profile incidents.

- Overview of regulatory responses aimed at enhancing consumer protection and payment security.

- Insight into trends in user adoption of innovative payment models and the factors influencing these shifts.

| Feature | Traditional Payment Processing | Innovative Payment Processing |

|---|---|---|

| Speed | Generally slower, taking several days for transactions to clear | Instant or near-instant transaction confirmations, often within seconds |

| Security | Relies on established banks and could be vulnerable to outdated systems | Uses advanced encryption, blockchain technology, and dynamic fraud detection techniques for enhanced security |

| User Experience | Often involves lengthy processes requiring multiple steps | Streamlined, user-friendly interfaces with one-click payments and mobile compatibility |

Rising Incidents of Unauthorized Transactions in Fintech

The landscape of financial technology (fintech) is becoming increasingly tumultuous, particularly with a notable surge in unauthorized transactions. A recent incident involving PayPal has drawn significant attention to the vulnerabilities in digital payment systems. In August 2025, German banks halted over 10 billion euros (approximately $11.7 billion) in PayPal transactions after identifying millions of suspicious direct debits. This alarming development has caused widespread concern across European financial institutions, notably those operating in Germany.

The German Savings Banks and Giro Association reported that these unauthorized transactions resulted from a malfunction within PayPal’s fraud detection mechanisms, allowing unchecked payments to proceed before being blocked. PayPal acknowledged the issue, emphasizing their collaboration with banking partners to swiftly address the matter. “We quickly identified the cause and are working closely with our banking partners to ensure that all accounts have been updated,” a PayPal representative stated during a press briefing.

These recent events highlight ongoing frustrations among users, who feel their trust in digital payment systems is being undermined. Many are increasingly concerned about how their financial data is protected in an era where unauthorized access can happen in the blink of an eye. Users express that such incidents make them hesitant to rely solely on fintech solutions for their everyday transactions.

Stakeholders are also vocal about the need for enhanced security protocols within fintech platforms. Adrienne Harris, Superintendent of New York’s Department of Financial Services, voiced her discontent, focusing on the lack of basic security measures. She stated, “The absence of multifactor authentication and CAPTCHA contributed to the 2022 data breach and emphasized the necessity for platforms to prioritize user security.” Meanwhile, experts in cybersecurity, such as Craig Lurey, Chief Technology Officer at Keeper Security, stress the importance of implementing advanced verification systems. Lurey noted, “Many businesses experience multiple cyberattacks annually; without robust defenses, unauthorized transactions will continue to rise.”

As digital payment systems evolve, so too must the security measures that safeguard them. Users and institutions alike are calling for extended vigilance and proactive solutions to protect against unauthorized transactions, especially as fintech continues to disrupt traditional banking paradigms. Without these advancements, trust in fintech could falter, impacting the entire ecosystem of digital transactions.

Regulatory Responses to Payment Fraud in Europe

The rise of payment fraud in Europe has prompted a series of responses from various regulatory bodies aimed at enhancing security and protecting consumers. Recent cases, particularly involving unauthorized transactions through platforms like PayPal, have highlighted the vulnerabilities in the payment processing industry and the urgent need for regulatory intervention.

1. Germany’s Financial Supervisory Authority (BaFin)

In the aftermath of a significant incident in August 2025, where German banks had to halt payments worth over €10 billion due to unauthorized transactions from PayPal, BaFin was actively involved in monitoring the situation. They sought to assess the impact of these unauthorized payments on the banking sector and ensure that banks strengthened their fraud detection systems to prevent similar occurrences in the future. This situation has led to calls for adopting more rigorous compliance measures and enhancing risk management practices in the payment processing industry.

2. European Banking Authority (EBA)

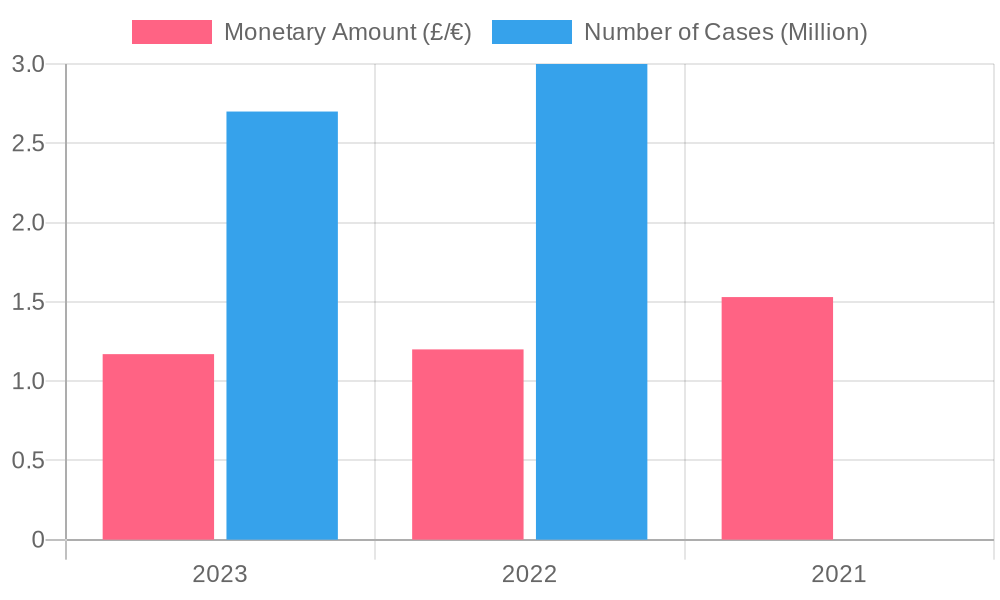

The EBA has played a crucial role by publishing reports and guidelines focusing on payment fraud. In 2024, EBA and the European Central Bank (ECB) released a joint report revealing that fraudulent transaction values surged to €4.3 billion in 2022, markedly influencing policy discussions around payment security. Additionally, they emphasized the effectiveness of Strong Customer Authentication (SCA) in mitigating fraud risks, reinforcing it as a mandatory standard in payment services.

3. Poland’s Antitrust and Consumer Protection Authority (UOKiK)

In July 2024, UOKiK imposed a fine of $27.3 million on PayPal due to vague contractual clauses that failed to clarify users’ rights and obligations, especially around prohibited activities. This regulatory action reflects a growing trend among European authorities to enforce clearer standards in consumer protection, aimed at ensuring transparency and accountability in digital transaction platforms.

4. Legislation Enhancements

The EU Council has deliberated on measures to modernize payment services across Europe, culminating in an agreement in June 2025 to enhance anti-fraud frameworks. Proposed initiatives include mandatory sharing of fraud-related data among payment service providers and verification systems to confirm that IBAN numbers match the associated account names, thus preventing unauthorized transactions.

5. Cooperation Initiatives

In February 2025, the European Commission organized a workshop with enforcement networks and key stakeholders to address the trends in online consumer fraud. The workshop focused on sharing best practices and enhancing collaborative efforts to combat fraud, particularly leveraging technology and AI in detection systems. Such initiatives underline the importance of a cohesive strategy in addressing the evolving challenges in the payment industry.

These regulatory responses indicate a significant shift in the approach toward combating payment fraud in Europe. Authorities are not only enforcing stricter regulations but also advocating for technological innovations and collaborative frameworks to maintain consumer trust in payment systems. As the fintech landscape continues to evolve, the interplay between regulatory measures and industry practices will be critical in shaping a secure payment processing ecosystem.

References:

User Perceptions of Payment Security in the Wake of Recent Events

In the constantly evolving landscape of fintech, customer perceptions of payment security have notably shifted, particularly following incidents such as unauthorized transactions involving PayPal. The panic generated by these breaches has fostered an environment of skepticism among users regarding the safety of their financial information.

Raising Awareness of Payment Security Issues

Recent events, including the suspension of over €10 billion worth of PayPal payments due to unauthorized direct debits, have raised significant alarm among users. A 2024 survey by Chubb revealed that 61% of respondents had altered their behavior or reduced their utilization of digital payment platforms due to fears of cyber scams. Many users expressed that enhanced transaction security measures, such as transaction insurance, would significantly increase their trust in these platforms [Chubb].

Moreover, consumer fears about unauthorized access to their accounts have become more pronounced. Approximately two-thirds of respondents indicated having been victims of digital fraud or knowing someone affected by such incidents. This data underscores the growing apprehension regarding fintech solutions, as users become increasingly cautious due to the perceived risks associated with payment platforms.

Impact of Cybersecurity Breaches on Trust

Incidents of data breaches, such as the high-profile case involving Evolve Bank & Trust in 2024, further illustrate the vulnerabilities tied to fintech. These breaches can lead to substantial financial losses, fueling consumer reluctance in adopting digital payment services [Evolve Bank & Trust]. In fact, users reported collective losses of $1.86 billion in 2023 arising from scams related to bank transfers and online payments [B2Bdaily].

Shifts in User Behavior

Despite the convenience associated with digital payments, security concerns persist. Around 60% of users have adjusted their payment behaviors, demonstrating a direct response to security threats, with younger consumers particularly alert and reactive to risks. However, nearly 89% of this demographic still actively use digital payments, illustrating the complex relationship between convenience and apprehension in user behavior.

Strategies for Regaining Consumer Trust

To combat skepticism, fintech companies are focusing on strategies to enhance consumer trust. Key initiatives involve:

- Enhancing Transparency: Clearly communicating security practices and policies to instill confidence in users [Moolah Solutions].

- Improving Customer Support: Providing responsive and empathetic support to address users’ concerns is critical to regaining their trust [Moolah Solutions].

- Implementing Robust Security Measures: Integrating advanced cybersecurity protocols and fraud detection technologies is essential to safeguarding user data [STL Digital].

Additionally, one user, Shayla King, shared her distressing experience with fintech fraud: “I will never in my life bank with an online bank again. That’s my car payment, my electricity bill … I’m a paycheck-to-paycheck person, and I’m still trying to climb out of that hole.” [Forbes]. This quote highlights the emotional toll and financial anxiety that such fraud can inflict on individuals.

In summary, user perceptions of payment security have shifted significantly in response to recent events. Fintech companies must prioritize fostering consumer trust through enhanced security measures, effective communication, and dedicated support to navigate these evolving challenges.

Stakeholder Perspectives on the Recent PayPal Incident

As the fallout from the recent PayPal incident unfolds, various stakeholders within the payment processing industry have expressed their thoughts and concerns regarding its implications:

- Bryan Bergin, TD Cowen Analyst: “It’s a major ‘existential’ technology upgrade for a company that’s considered the ‘grand-daddy’ of the fintech industry. Large organizations need modern technology, and that’s a component of this.”

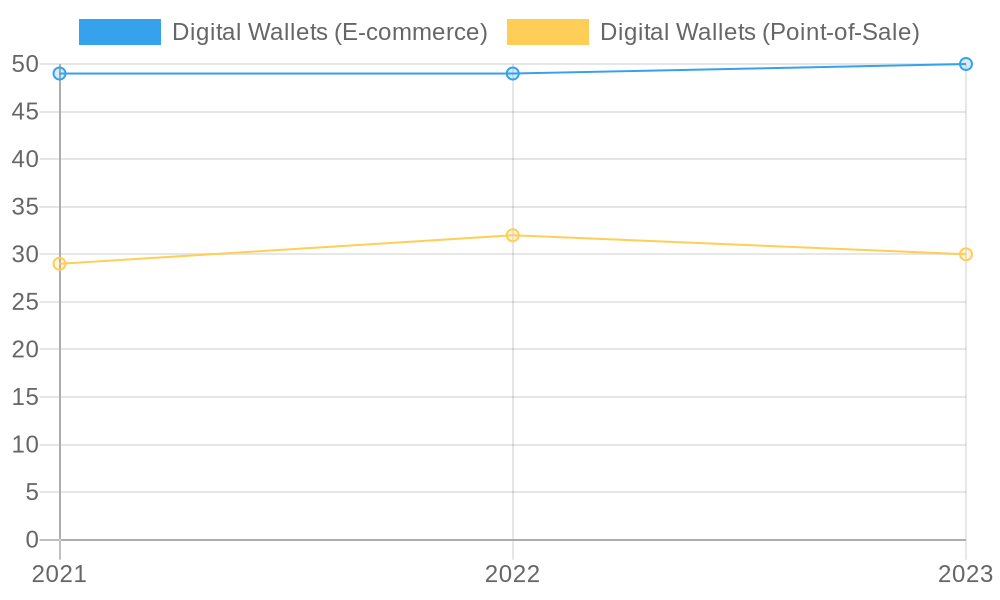

Read more - Goldman Sachs Analysts: They noted being “cautious on branded checkout competitive dynamics longer term, as mobile-based wallets continue to gain share.”

Read more - Ann Berry, Founder of Threadneedle: Expressing concern she stated that PayPal “should be winning on gaining share.”

Read more - Tamer Soliman, Analyst: He cautioned that “Contrarians buying the dip could be painful. There is a significant risk that shares could decline further if PayPal’s growth slows down.”

Read more

These perspectives underscore a cautious tone prevailing across the industry, as stakeholders navigate the challenges presented by such incidents while contemplating future strategies and technological improvements.

Conclusion

The realm of fintech innovation in payment processing is experiencing a profound transformation, driven by the changing demands of consumers and technological advancements. As evidenced by the recent incidents of unauthorized transactions linked to major platforms like PayPal, the challenges facing European banks and consumers are both significant and urgent. These rogue payments have exposed vulnerabilities within digital payment systems, underscoring the necessity for robust fraud detection mechanisms to preserve trust in fintech solutions.

While fintech models continue to evolve, they present a dual-edged sword: offering unparalleled convenience and efficiency while also demanding heightened vigilance against emerging security threats. Unauthorized transactions not only jeopardize consumer confidence but also threaten the stability of financial institutions, which must now adapt swiftly to safeguard their clients.

European banks must collaborate with fintech providers to develop innovative security frameworks that integrate advanced technologies like artificial intelligence and blockchain. Additionally, regulatory bodies will play a critical role in shaping policies that ensure stricter compliance and robust security standards for payment processing. On the consumer front, awareness and education around the risks of unauthorized transactions will be paramount in fostering a sense of security in digital finance.

Looking ahead, the implications of these trends signal a pressing need for a proactive approach. Both banks and consumers must remain agile, preparing to navigate an increasingly complex landscape of payment technologies where innovation is matched only by the potential for risk. Ultimately, the future of payment processing lies in successful partnerships between fintech innovators and legacy banking systems, focused on secure, transparent, and trustworthy financial transactions.

User Adoption Data on Innovative Payment Models

User adoption of innovative payment models, such as mobile payments and contactless transactions, has been significantly influenced by factors related to security and convenience when compared to traditional payment methods. Recent research provides key insights into this shift:

- Security Increases Adoption: Many users are becoming increasingly aware of security concerns surrounding payment models. Trust in service providers, including financial institutions and technology companies, is essential for encouraging the adoption of cashless methods. Users need to feel secure about their data being protected, which enhances their willingness to utilize these platforms

[Emerald Insight]. - Perceived Ease of Use: Research indicates a strong correlation between perceived ease of use and positive attitudes towards innovative payment systems. Many consumers find mobile money services and contactless payment options more convenient compared to traditional payment methods, leading to higher adoption rates among users

[Springer Journal]. - Social Influence: Peer pressure and recommendations play a significant role in user adoption. Individuals are more inclined to adopt new payment technologies when they see friends and family using them. This social aspect encourages a quicker shift towards adopting innovative payment options

[Frontiers in Psychology]. - Impact of Technology Infrastructure: The availability and quality of technical infrastructure, such as reliable internet access and compatible devices, are critical for the success of innovative payment solutions. Users are more likely to adopt these models in environments where technology enhances their overall experience

[TryEdge]. - Trends in Adoption Rates: Adoption rates for innovative payment methods are increasing, particularly among younger adults and tech-savvy users who engage more actively with digital finance solutions. The ongoing transition from traditional payment methods to innovative alternatives is evident, indicating a significant trend in consumer behavior.

In conclusion, the shift towards innovative payment models is largely driven by their perceived security and convenience compared to traditional systems. The growing trends in user adoption signify a transformative shift in financial transactions, pushing the industry towards more modern and efficient solutions.

Additional Resources on Digital Payment Safety and Financial Security

To enhance your understanding of digital payment safety and financial security best practices, consider checking out these authoritative sources:

- Security best practices for digital payment apps and wallets | Ally

This guide provides comprehensive tips on securing your digital wallets and payment apps, including advice on password management and encryption. - 5 online payment security best practices for enterprises | TechTarget

Here you can find insights for businesses on how to mitigate risks in online payment transactions, including the importance of constant software updates and secure network practices. - Security and Fraud Prevention in Digital Payments

This article discusses advanced strategies for fighting payment fraud and enhancing security measures for digital transactions, relevant for both consumers and organizations.

Utilizing these resources can equip you with essential knowledge to safeguard your financial transactions and strive for the best practices in digital payment security.